Basic Concepts

The Japanese Candlestick Chart

Candlestick charts were developed in Japan in the 1700s, more than a century before the West came up with bar charts. Munehisa Homma, realized price was affected by traders’ emotions and not just supply and demand. The candlestick chart was created to help traders see the impact of these emotions on the market.

Candlesticks show price movement by using two colors. One color indicates that price is dropping, while the other shows that price is rising.

Traders can use candlesticks and the patterns they form to decide on their trading strategy in the short term. For example, a specific pattern made up of multiple candlesticks could represent a continuation of a trend or a reversal. A particular candlestick formation could indicate an entry or exit point.

What Is a Candlestick Chart?

A candlestick chart is a chart comprised of individual candlesticks, like the ones pictured below.

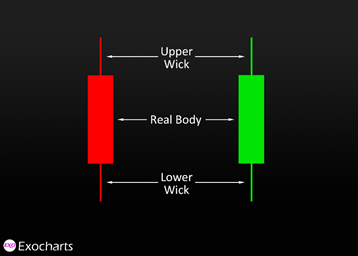

A candlestick consists of two main elements: the real body and one or two wicks, (also referred to as upper and lower shadows). At the top of the candle is the upper wick, while at the bottom is the lower wick.

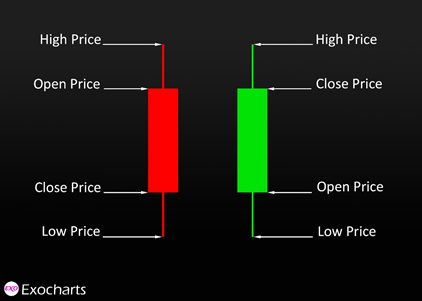

The real body represents the range between the open and closing price of a particular time frame.

A red [or bear] candle indicates that price closed lower than it opened. Conversely, a green [or bull] candle shows that price closed higher than it opened.

Wicks show the highest and lowest prices of that candlestick’s time frame. Sometimes, candlesticks will be missing one or both wicks.

For a bear candle, a missing lower wick indicates that price didn’t move below the close of the candle. A missing upper wick shows that price didn’t move above the open price. The reverse applies to a bull candle.

Traders can choose the time frame based on their trading preferences. Time frames usually range between 30 seconds and one month, with each candlestick showing price movements during that period.

Candlestick Charts vs. Bar Charts

Candlestick charts and bar charts provide the same information, but it’s displayed differently. Candlestick charts offer a better visual representation than bar charts.

The thicker bodies better show the difference between the open and close. They also make the highs and lows of the timeframe more obvious.

Bar Chart

Candlestick Chart

The top chart shows colored bars, while the bottom chart shows colored candlesticks. Depending on the trading/charting platform, traders can usually change the colors to suit their preferences.

However, the most common colors tend to be red or black for bear candlesticks (when price closes below the open) and green or white for bull candlesticks (when price closes above the open).

Order Flow Analysis

In order flow analysis, charts show the volumes traded on bid and ask, and not just price. Therefore, instead of just seeing the prices at which trades occurred, you’ll also see the volume of trades both on the buy and sell side.

Since it relies on current data, the advantage of order flow analysis is that it provides valuable insight into market conditions and psychology. It also provides the aid for the confirmation for tops and bottoms, helps you see where supply and demand have changed, and more.

A traditional candlestick chart only plots price movement, showing the open, high, low, and close prices for a particular timeframe. An order flow chart, on the other hand, also shows how much was bought and sold. In other words, you can clearly see the strength of the sellers and the buyers.

Proponents of order flow analysis believe that a trader should focus on how the market is moving and not be distracted by external fundamental data.

For example, fundamental analysis might make efficient predictions in the long term, but it might be entirely wrong for the short term. Hence, those who are wanting to trade short-term movements in the markets mustn’t rely heavily on fundamental data. An example of fundamental data would be information provided by news channels and the media, concerning the finances of a person or certain group of people.

Is Order Flow a Form of Technical Analysis?

Based on the approach order flow analysis uses, some might believe it is another form of technical analysis, but that is not entirely accurate.

Technical analysis, depends on using tools, which are mathematically programmed to, make an assumption on where price changes may occur at, for instance the Fibonacci retracement tool is commonly used for technical analysis.

On the other hand, order flow analysis allows traders to see how the marketing is changing in real-time, with the provided statistical information previously mentioned. Order flow analysis therefore allows you to make immediate informed decisions, which when put alongside technical analysis instruments creating confluence, enhances the abilities a trader has to minimise losses and maximise gains.

Benefits of Order Flow Analysis

While price is a function of supply and demand, as technical analysis assumes, that’s not the full picture. Supply and demand are driven by people’s emotions – their needs and what they believe their needs will be in the future.

With order flow analysis, you can see clearly where buyers and sellers are entering the market. An order flow chart allows you to determine the strength of the buyers and sellers, to see weak lows and highs, and more. Essentially, it lets you make far more informed decisions.

It also allows you to see what is happening in the market right at that moment, allowing you to make the most of trading opportunities as they appear.

Other benefits of order flow trading include:

-

Helping you to see when market behavior will change as it’s happening

-

Showing you reasons based on data given, why price changed direction at a particular level

-

Revealing changes in supply and demand, so you know if and when to get out of a losing trade

-

Enabling you to determine when to open a trade

-

Allowing you to trade with far less risk and stress.

Order flow analysis eliminates the noise, allowing traders to focus on what is happening in the market. After all, a chart filled with a slew of indicators might indicate price will rise, but that is not necessarily what’s going to happen. Likewise, fundamental analysis might indicate the market will correct, but what might happen is not always what will happen.

Cryptocurrency Exchanges: An Overview

A cryptocurrency exchange, also known as digital currency exchange (DCE), allows you to buy or sell cryptocurrencies using fiat currencies and digital assets. Essentially, it’s a system that matches sellers and buyers.

Fiat describes currencies that have been declared legal tender by a country’s government, such as U.S. dollars, euros, yen, pounds, rand, and yuan. Digital assets represent electronic items, such as domain names, cryptocurrencies, and files.

Typically, cryptocurrencies are open 24/7, so you can trade day and night. Some of these businesses operate exclusively online, while others also offer their services in physical locations. However, online platforms are the most prevalent.

Types of Exchanges

Cryptocurrency exchanges can differ significantly from one another, especially in terms of the features and options they offer. Some, for example, are set up to appeal more to traders, while others are dedicated to people who want to buy or sell cryptocurrencies quickly.

Furthermore, cryptocurrency exchanges can be centralized or decentralized.

Centralized Exchanges

Centralized exchanges tend to be operated by a company that makes a profit from the fees they charge. In this case, the exchange controls the funds, and the transactions are not anonymous since the company has to meet Know Your Customer (KYC) regulations.

Transactions are carried out using methods offered by a central authority that supervises daily operations.

A centralized exchange has the advantage of high liquidity but the disadvantage of a higher risk of being targeted by hackers.

Decentralized Exchanges

Decentralized exchanges don’t rely on third-party services. As such, users control their funds, which means there is a lower risk of price manipulation and fraud.

In this case, all transactions are completely anonymous since there is no entity that needs to conform to Know Your Customer [KYC] rules.

The advantage is limited exposure to theft and hacking, while the drawback is a lower level of liquidity.

How It Works

First, it’s important to clarify that exchanges do not affect price in any way. Like with any other financial market, the price fluctuates based on supply and demand.

To purchase cryptocurrency through an exchange, you first need to fund your account, which is also referred to as a wallet. You can fund your wallet with another cryptocurrency or a fiat currency. For the latter, you can use a debit/credit card or wire transfer, depending on the exchange.

You then open a “buy” order, which essentially means that you’re asking to buy a cryptocurrency. All sell and buy orders are registered in the order book, which lists how much of a cryptocurrency traders want to buy and sell in total, along with the prices they’re asking or looking for.

So, if there’s a seller who is offering the cryptocurrency at the price you want, then you will be able to make the purchase. Of course, if you set an unrealistic price, your buy request will not be filled.

Top Exchanges for Traders

Some of the best cryptocurrency exchanges for traders include Binance, OKEx, Coinbase, BitMEX, Kraken, Swapzone, ByBit, and FTX. Exocharts offers real-time data from the following exchanges:

BitMEX is a cryptocurrency and derivatives trading platform that offers up to 100x leverage. They promise quick execution and attractive fees. It is the largest bitcoin futures market in terms of volume traded in the world. At the beginning of 2021, the platform claims to have achieved a trading volume of $1 trillion over 365 days.

ByBit is operated by a Singapore-based trading platform that uses a pricing model based on maker fee and taker fee. They have a decent trading volume, as evidenced by the fact that they do $800 million per day across just four of their assets.

OKEx is a trading platform that allows you to trade 471 spot and futures markets, making it one of the biggest exchanges worldwide. In terms of trading volume, it is ranked 14th. According to the exchange, over 20 million traders from more than 200 countries trade using their platform.

FTX is a reputable cryptocurrency exchange specializing in futures, indices, derivatives and leveraged tokens. Margin trading is available. This platform has a trading volume of $2.73 billion per day. This exchanged is backed by Almada Research, one of the top providers of cryptocurrency liquidity that manages hundreds of millions of cryptocurrencies and other digital assets every day.

Binance Futures is an exchange that allows the use of an impressive range of cryptocurrencies as collateral. They offer two types of futures contracts, namely COIN-M Futures and USDⓈ-M Futures. As you might expect, Binance Futures’ parent company is Binance, one of the largest and most reputable crypto platforms globally. In May 2021, Binance achieved a trading volume of $2.46 trillion, making it the biggest platform in terms of volume traded in the world.

Fundamental Market Analysis

Fundamental analysis is a way traders can measure the value of the asset they want to trade by studying related financial and economic factors.

When conducting fundamental analysis, a trader will look at any macroeconomic or microeconomic factors that could affect the asset’s value.

Macroeconomic factors include the economic environment and interest rates, while microeconomic factors include aspects such as the profitability of a business and a company’s competitors.

The goal of fundamental analysis is to predict whether a security is trading at a fair price or if it’s under- or overvalued.

If the asset is undervalued, meaning that it is trading below what is deemed fair market value, it is considered a good buy opportunity. The assumption is the price will rise to reach or exceed fair market value.

Technical Market Analysis

Traders use technical analysis to identify and evaluate opportunities. Unlike fundamental analysis that focuses on macro- and micro-economic factors, technical analysis focuses on statistical trends that result from trading, like trading volume and price movement.

How Technical Analysis Works

Technical analysis is all about price and volume. Traders use various tools to examine how the supply and demand of a security impact price, volume, and volatility.

This form of analysis applies to any security with historical data, including stocks, cryptocurrencies, and commodities. However, while technical analysis applies to any security, it is far more prevalent in forex and crypto trading, as traders focus more on short-term price movements.

The core of technical analysis revolves around the idea that past price changes and trading activity provide valuable data that can help effectively predict future price movements. As a result, when used as part of an effective trading plan that includes a risk management strategy, technical analysis can help traders make a profit.

It should be noted that while some retail traders use only technical analysis, experienced traders use multiple forms of analysis when making trading decisions.

So, technical analysis involves using past data to predict the future, largely by studying how supply and demand affect the price of a security. While many traders use technical analysis mainly to examine price, some also use it to analyze other aspects of trading, such as open interest or trading volume.

Since its inception, experts have created numerous signals and patterns to improve their analysis and trading systems to help them profit from price movements. As a result, traders have access to a wide range of indicators of different types based on what they analyze. Some of these categories of indicators include:

-

Price trends

-

Chart patterns

-

Volume indicators

-

Momentum indicators

-

Support and resistance levels

Understanding the Guiding Principles of Technical Analysis

Charles Dow made two assumptions regarding technical analysis that still act as a framework today. Thus, according to Dow, a market is efficient and the value of a security reflects the variables that affect its price. Furthermore, price movements tend to form repeatable patterns and trends, even when the movement seems random.

Experts expanded on Dow’s work and, now, the following three assumptions are widely accepted:

-

A security’s price already reflects the effects of every factor that might affect it, including market sentiment. Therefore, the only thing a trader needs to do is analyze price movement, which is the result of supply and demand.

-

No matter how random price movements seem, they still form trends, regardless of the time frame. Most trading strategies that rely on technical analysis assume that price is less likely to move unpredictably than it is to continue in line with a historical trend.

-

History repeats itself, thanks in large part to market psychology. Technical analysts look at chart patterns to attempt to determine what market participants are feeling and how those emotions move price.

Limitations of Technical Analysis

Some experts feel that historical data can’t provide them with actionable insights, which they claim proves technical analysis is ineffective. However, by the same logic, fundamental analysis is ineffective since it also uses historical data.

Another concern regarding technical analysis is that while history might repeat itself, it doesn’t do it exactly. Therefore, studying price patterns is a waste of time.

Finally, another perceived limitation of technical analysis is that it creates a self-fulfilling prophecy, which is the only reason it sometimes works.

Many traders use the same indicators and similar strategies, so, if their set-up shows them that price has hit a support level, they will buy. The more traders buy, the more price will increase, thereby creating a self-fulfilling prophecy.

All forms of analysis have some limitations, which is why expert traders use both fundamental and technical analysis and other resources.